THINKING ABOUT SELLING YOUR HOME?: KEY QUESTIONS ANSWERED

There’s no denying mortgage rates are having a big impact on today’s housing market. This dynamic situation may leave you wondering whether it still makes sense to sell your house and make a move. Here are three of the top questions you might be asking, along with data to help answer them.

1. Should I Wait To Sell?

If you’re considering waiting to sell until mortgage rates come down, here’s what you need to know: a lot of other people are thinking the same thing. While mortgage rates are forecasted to decrease later this year, waiting for that drop could mean facing significantly more competition from both buyers and sellers who jump back into the market at the same time.

This influx of activity can lead to rising prices and more multiple-offer scenarios, making it harder to secure your next home at a favorable price. Selling now, while the market is less crowded, might give you a strategic advantage.

2. Are Buyers Still Out There?

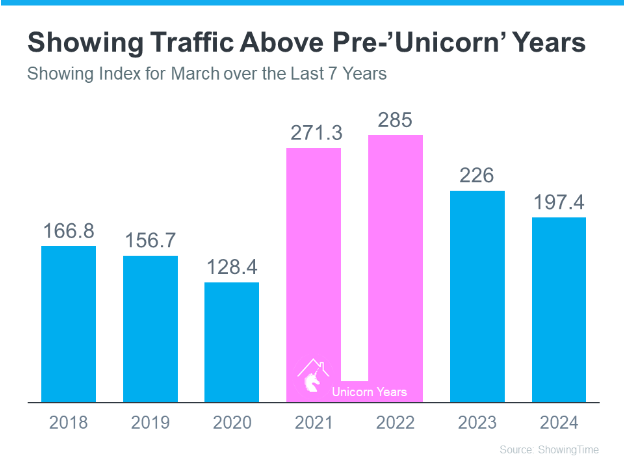

While some potential buyers are holding off due to higher mortgage rates and rising prices, there are still many active buyers in today’s market. The ShowingTime Showing Index, which measures how frequently buyers are touring homes, provides insight into this activity.

The latest data for March shows that while buyer demand has dipped from the peak 'unicorn' years (2020-2021), it remains strong compared to the last normal years in the market (2018-2019). This suggests that, despite the challenges, there is still a robust market for your house.

Focusing on the blue bars in the graph (representing the normal years) highlights that demand in 2024 is still high, indicating plenty of buyers are ready and willing to purchase homes. Therefore, listing your home now could attract serious buyers who are navigating the current market conditions.

3. Can I Afford To Buy My Next Home?

Concerned about affording your next home with today's mortgage rates and prices? Consider this: you likely have more equity in your current home than you realize. Homeowners have gained record amounts of equity over the past few years, and this equity can play a significant role in your next home purchase.

Jessica Lautz, Deputy Chief Economist at the National Association of Realtors (NAR), explains:

“ . . . those who have earned housing equity through home price appreciation are the current winners in today’s housing market. One-third of recent home buyers did not finance their home purchase last month—the highest share in a decade. For these buyers, interest rates may be less influential in their purchase decisions.”

With substantial equity, you might be able to make a large down payment or even buy your next home outright, reducing or eliminating the need for a mortgage and mitigating the impact of high interest rates.

Bottom Line

If these three questions have been on your mind and holding you back from selling, hopefully, this information provides some clarity. A recent survey from Realtor.com found that over 85% of potential sellers have been considering selling for more than a year. This indicates that many sellers are on the fence.

However, the same survey revealed that 79% of those who recently listed their homes wished they had sold sooner. This sentiment underscores the potential benefits of acting sooner rather than later.

If you want to discuss any of these questions further or need more information, contact a real estate agent. They can provide personalized advice and help you navigate the complexities of today’s housing market.

Latest News

DO YOU WANT TO BUY OR SELL A PROPERTY?

Have a property that needs to be sold? Or do you need to buy a property? Send us a message or call us and we’ll be in touch as soon as possible.

Navigation

Navigation

Location

11812 San Vicente Blvd #100

Los Angeles, CA 90049

PROPERTY ORGANIZER

Each office is independently owned and operated. DRE# 01978349

Copyright © 2025 The Cunningham Group.

All Rights Reserved. Privacy Policy

Copyright © 2025 The Cunningham Group. All Rights Reserved. Privacy Policy